nh transfer tax calculator

Who pays the transfer tax in New Hampshire. NH Real Estate Transfer Tax Rate Table Purchase price rounded up to the next 100 x 015 Tax is rounded up to the next dollar amount 40 minimum tax for purchase less than 4000.

New Jersey Nj Tax Rate H R Block

An original Form PA-34 Inventory of Property Transfer aka Real Estate Transfer Questionnaire must be filed with the Department within 30 days from the recording of the deed.

. Does New Hampshire have a mortgage excise or recordation. The RETT is a tax on the sale granting and transfer of real property or an interest in real property. The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value.

Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of. Your average tax rate is 1198 and your. Monday Friday 800 AM 400 PM.

Delaware DE Transfer Tax. The tax is imposed on both the buyer and the seller at the rate of 75 per 100 of the price or consideration for the sale granting or transfer. Open an Account Earn 14x the National Average.

From to transfer tax tax2 4001 4100 62 31 4101 4200 63 32 4201 4300 65 33 4301 4400 66. The assessed value multiplied by the real estate. New Hampshire Gas Tax.

The average effective property tax rate in. Select PUD if property is in a Homeowers Association. Easy 247 Online Access.

The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases. New Hampshire Income Tax Calculator 2021. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev.

4500 2 2250. A copy of the. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. The New Hampshire Real Estate Transfer Tax is a tax on the sale of real estate in the state of New Hampshire. New Hampshire Salary Tax Calculator for the Tax Year 202223 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223.

Nh transfer tax calculator. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access. The tax is 05 of the sale price of the property and is paid by the.

The State of Delaware transfer tax rate is 250. No monthly service fees. May vary by property location please contact office for amount.

Cities With The Lowest Tax Rates Turbotax Tax Tips Videos

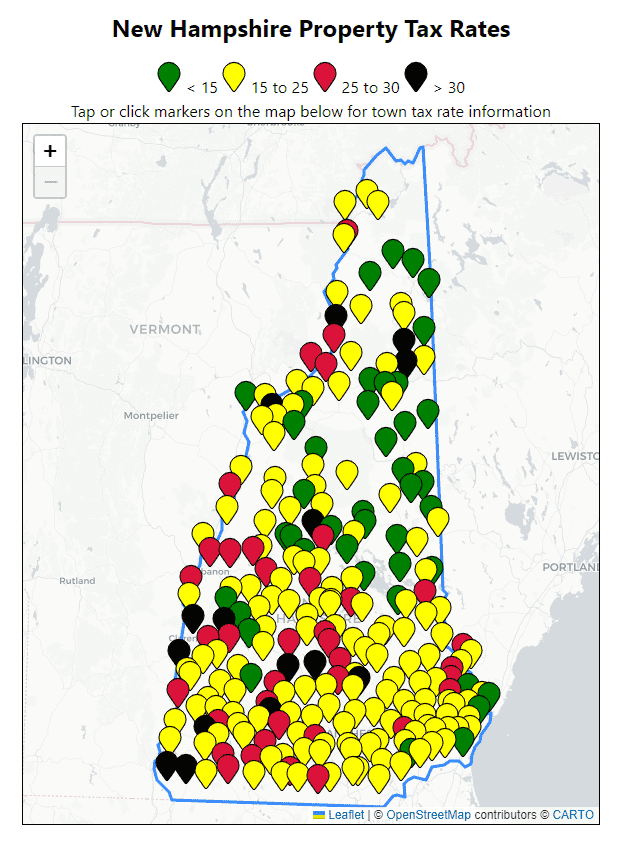

All Current New Hampshire Property Tax Rates And Estimated Home Values

Ebay Or Etsy Sale Of 600 Now Prompt An Irs Form 1099 K Money

Property Taxes Nh Issue Brief Citizens Count

![]()

An Overview Of New Hampshire Real Estate Transfer Taxes And Who Is Responsible For Them

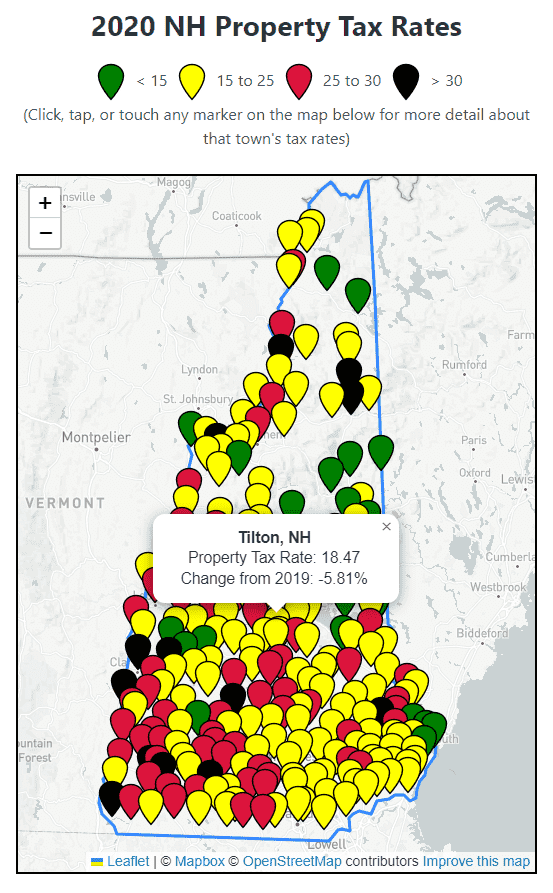

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

Summerfest Town Of Stratham Nh

Sales Taxes In The United States Wikipedia

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Buyer Closing Costs How Much Will You Pay

South Dakota Real Estate Transfer Taxes An In Depth Guide

How To Calculate Transfer Tax In Nh

Property Tax Information Town Of Exeter New Hampshire Official Website

Homebuyer Tax Credit New Hampshire Housing

How To Calculate Transfer Tax In Nh

New Hampshire Income Tax Calculator Smartasset